FAQ

Working through an umbrella company

Umbrella companies can be confusing, particularly for lower-paid workers. Often they aren’t very transparent about what they do, but there is also a lot of misinformation which gives them a bad name - even the ones that take the welfare of their workers very seriously.

Here we give you some clear and independent information to help you understand more about working through an umbrella company and some tips on what to look out for so you can avoid any problems.

-

What is an umbrella company?

Umbrella companies are businesses that take on agency workers and other types of temporary workers as their own employees with continuous contracts of employment. Their sole purpose is to employ people like you (often called ‘contractors’). To meet the rules to be a ‘continuous’ employment, the umbrella company must usually pay you for 336 hours of work per year at the minimum wage.

TIP: There is no single definition of an umbrella company – anyone can set up a company and label itself an umbrella company. Most umbrella companies are compliant with employment and tax law, but some aren’t – and the sector is currently unregulated – so you need to be on guard.

-

Why have I been told to use an umbrella company?

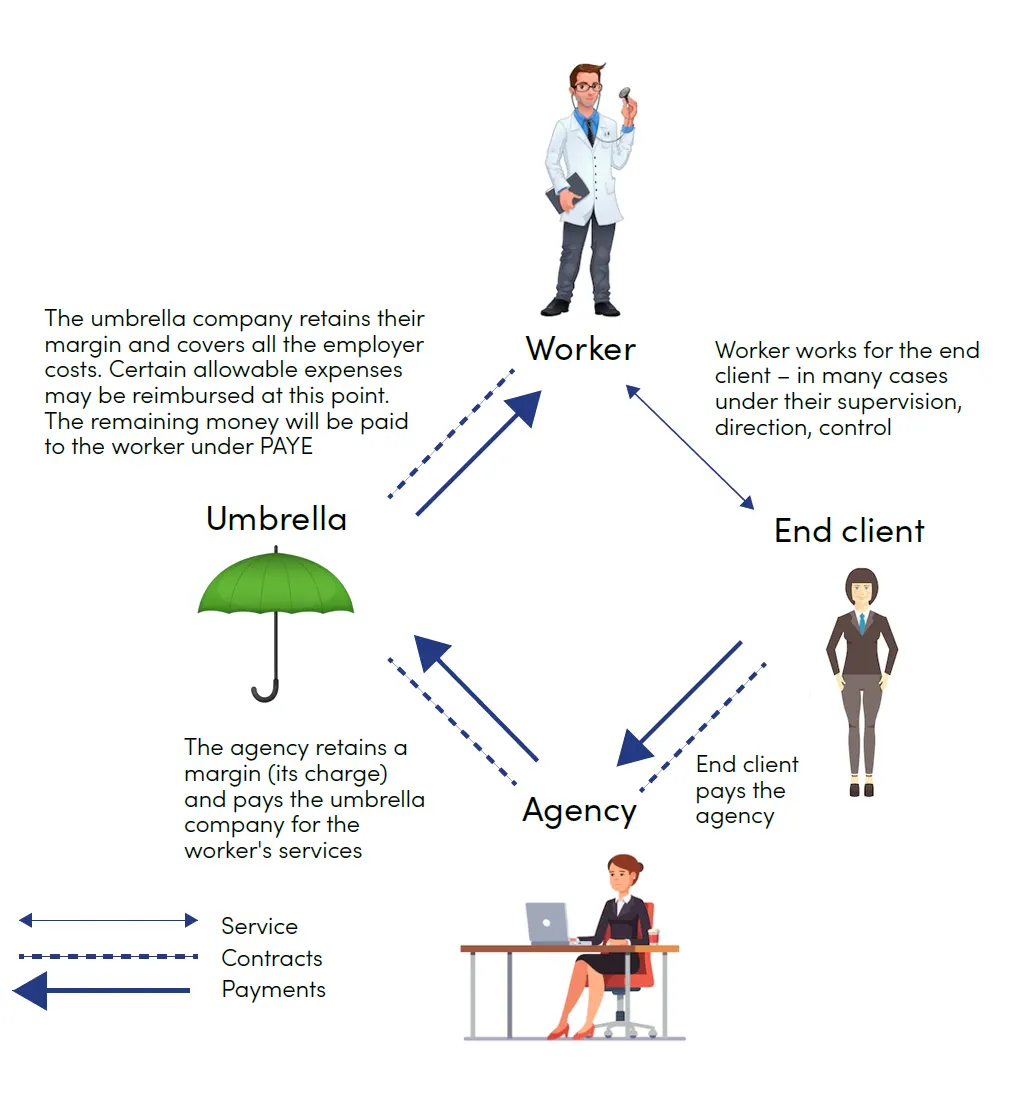

Historically, if you found work through an agency, they would normally deal with your pay themselves. However these days, agencies prefer not to do this as it saves them time and money and means they can concentrate on matching workers with available work. As such, they usually suggest that people use an umbrella company. It isn’t against the law for them to do this, although when they pass you over to an umbrella company they should make sure they also hand over sufficient funds to cover all the employment costs that the umbrella company will now have. This should include an amount to cover the umbrella company charge (more on this later).

Because the umbrella company becomes your employer, they will deal with your pay and other employer obligations instead of the agency. This includes paying you your wages with tax and National Insurance (NIC) deducted as required by the Pay As You Earn (PAYE) system.

TIP: If you feel very strongly that you want to be paid by the agency and not an umbrella company then you should try talking to the agency. However you should be aware that not all agencies run PAYE schemes themselves anymore. Also be aware that some agencies are incentivised by a commission into encouraging you to join up to a particular umbrella company (rather than the quality of the umbrella). Think carefully before joining up!

-

How does an umbrella company work?

This is probably best explained by way of a diagram:

-

What are my employment rights if I use an umbrella company?

You are an employee of the umbrella company and so have the same rights as any other employed person. These include the right to be paid the minimum wage, the right to paid holiday (more on this later), the right to be auto-enrolled into a pension (if you meet the relevant criteria) and to statutory benefits such as sick pay and maternity pay (provided you meet the relevant criteria). You can find more information about employee rights on GOV.UK.

It is worth noting that as an agency worker, you would get the main employment rights even if you did not work through an umbrella company. Working through an umbrella company can be beneficial in other ways, however. For example, it can provide a continuous payroll link from one assignment to the next, preventing problems like ‘emergency’ tax when you start a new assignment through a new agency. Sometimes they also provide things like shopping discounts and an online portal where you can track your pay.

TIP: Different umbrella companies will advertise different ‘perks’, sometimes at a cost. Some of these may be worth very little or may not be relevant to you, so you should weigh things up carefully before choosing an umbrella. You should also make sure you do not get caught up with problematic ‘mini’ umbrella companies – there can be a nasty impact on your employment rights, among other things.

-

Do the Agency Workers Regulations still apply?

Agency Workers Regulations (AWR) mean that agency workers should receive equal treatment compared to the end client’s own employees. Umbrella company employees are still classed as agency workers for the purposes of AWR. For example, you should be allowed to use any shared facilities (e.g. a staff canteen or childcare) from the first day you work in an assignment location. After 12 weeks’ continuous employment in the same role, you should get the same terms and conditions as the end client’s own employees, including pay and any annual leave above the minimum 28 days required by law (more on this later). There are rules in place which mean that your assignment cannot just be stopped as you get near 12 weeks of continuous work. You can find out more about AWR on the ACAS website.

TIP: LITRG’s new report on umbrella companies, looks in depth at the question of employment rights for umbrella company workers. One of the aims of the report is to help workers inform and protect themselves.

WARNING! Non compliant disguised remuneration models

There are lots of umbrella companies out there and the marketplace is very competitive. All umbrella companies should apply the same tax and employment law rules (although their margins may differ) and therefore what you are offered should broadly be the same from one umbrella company to the next. Any umbrella company that appears to offer higher than expected take home pay should be avoided as it is likely that they are doing something that is just not right to try and reduce their costs.

TIP: You need to be extra vigilant about being offered or given payment in the form of loans, grants, advances etc. (even if it has a ‘QC’s opinion’ or appears to have been ‘approved’ by HMRC). This is likely to be ‘disguised remuneration’ and it does not tend to end well for workers. Some possible warning signs of disguised remuneration schemes for you to be wary of are: not receiving a payslip or receiving a payslip that shows a different ‘net’ amount to what you received; perhaps receiving more than one payment into your bank account each pay period; and information in your Personal Tax Account about your pay and taxes that does not match what you are being paid.

-

I heard I can claim some relief on my travel expenses?

It used to be the case that if you worked though an umbrella company then you could claim tax and NIC relief on the costs of getting to and from your assignment locations. However since April 2016, this has been closed to anyone working under ‘supervision, direction or control’ of any person (or the right thereof). This catches most people.

However you may still qualify for relief on travel expenses incurred while working (e.g. going to a client meeting), as opposed to getting to work. Strictly you should put in a tax claim to HMRC to claim tax relief on mileage and other types of travel expenses but some umbrella companies may offer to process them through the payroll on a tax and NIC free basis for you. You should make sure you are clear as to the grounds on which they are doing this, for example, because the expenses are client or agency reimbursed expenses. For more information about what the expense rules are see the LITRG report on umbrella companies.

TIP: Be wary of any umbrella companies that say they can still process home to work travel expenses. While it is the umbrella’s responsibility to ensure that only correct expenses are claimed and processed through them, if they get things wrong, there may be consequences for you.

-

How will my holiday pay be calculated?

The starting point is that full-time workers have the right to a minimum of 28 days’ paid leave including bank holidays (although you could be entitled to more under the Agency Workers Regulations, as explained previously). If you work on a casual basis or very irregular hours, your holiday entitlement will probably be calculated as a percentage of your hours. 28 days is equivalent to 12.07% hours. Example: Mary works 17 hours one week, 20 hours the next week, and then 15 hours for next two weeks. After a month of working, she has built up entitlement to approximately 8 hours of paid leave (67 hours x 12.07%).

Many umbrella companies offer to include an amount for holiday pay in your wages on an ongoing basis (a system known as ‘rolled up’ holiday pay). Strictly this is incorrect, as the law says that it should be paid out at the time annual leave is taken, but many workers prefer the ’rolled up’ system.

If you are not on a rolled up system and you leave the employment having taken fewer holidays than you are entitled to, you should be paid in lieu of the untaken holiday. So carrying on Mary’s example, if her employment ended before she could take the leave she had built up, she would be entitled to be paid in place of taking the leave. If she usually earned £9 an hour, she would be entitled to £72 (holiday pay is calculated based on your average pay rate in the preceding 52 weeks including bonuses, overtime, commission where relevant). There is lots of information about holiday pay on the GOV.UK website.

TIP: Check how the umbrella company will deal with your holiday pay – if it is not on a ‘rolled up’ basis ask them to confirm the circumstances in which you may lose the holiday pay (for example, if you do not request it before the end of the holiday year). If you leave the umbrella company, ask them to confirm that all outstanding holiday pay will be paid to you with your final payment.

-

How much will I be paid if I work through an umbrella company?

This is where things can get quite complex – so much so, that people often think they are being ’scammed’ by an umbrella company when they get their first payslip. But let us explain once and for all how things should work.

If you are paid by an agency directly, then the rate they offer you (commonly known as the PAYE rate) is the amount, before your tax and NIC, that you should receive. So if you have a PAYE rate of say, £9.50 per hour and work 35 hours you will be paid £9.50 x 35 = £332.50 as gross taxable pay. You will then have your PAYE tax and employee NIC deducted from this, in the same way as all other employees. But £9.50 is not the true cost to the agency of paying you. In addition, they may have to pay things like employers’ NIC, holiday pay, apprenticeship levy and contributions into a workplace pension. As such, the cost to them of taking you on may be something more like £12.15 an hour. But you are not entitled to be paid the full amount of £12.15 – you are only entitled to the £9.50. Hopefully you are familiar with this concept from any other employments you have been in.

When an agency hands you over to an umbrella company, they should pass the umbrella company the full costs of your employment – that is, the £12.15 an hour (from the funds they themselves have received from the end client). This is commonly known as the limited company rate. They may explain to you that you can get £9.50 an hour if you are paid through them, or £12.15 an hour if you are paid through an umbrella company. The ‘headline’ rate of £12.15 an hour can sound like a great deal if the agency do not properly explain to you that it is intended to cover the total costs of employment and is not the amount you are going to personally earn! As such it can be very tempting to go with the £12.15 an hour – but you may then get a shock when you get your payslip and see things like employer NIC being deducted.

The bottom line however is that the limited company rate should be sufficiently more than the PAYE rate, so that once all the additional employment costs have been deducted, and the umbrella company charge has been deducted, you are in no worse a position than if you had just received the PAYE rate in the first place. This can be very hard to work out unless you are a tax expert or have some special computer software to do the maths for you, so to help you we have prepared a table that shows, approximately, what the minimum equivalent limited company rate should be for some common PAYE rates.

TIP: Ask your agency for both their PAYE rate and limited company rate when looking at a potential assignment.

PAYE rate v Limited company rate – Ready reckoner

Please note that this is just a 'ready reckone' but should help you understand whether what you are being offered to work through an umbrella company is roughly right. For the purposes of this table, we have assumed that a worker is working 35 hours per week and that the umbrella is making a GBP20 'margin' a week that is, the charge for their services. This margin should be factored into the limited company rate – if the umbrella company charges more, the equivalent rate will be slightly higher and if they charge less the equivalent rate will be slightly lower.

This table is based on the 2021/22 rates and allowances for things like employer's NIC and auto-enrolment. For anyone with a technical interest in the figures, they can be found on GOV.UK.

TIP: If your circumstances do not fit neatly within this table then give the umbrella company the PAYE rate and the limited company rate you have been quoted by the agency. A good umbrella company should help you understand what the rates mean and which one works out best for you based on your actual circumstances.

Example

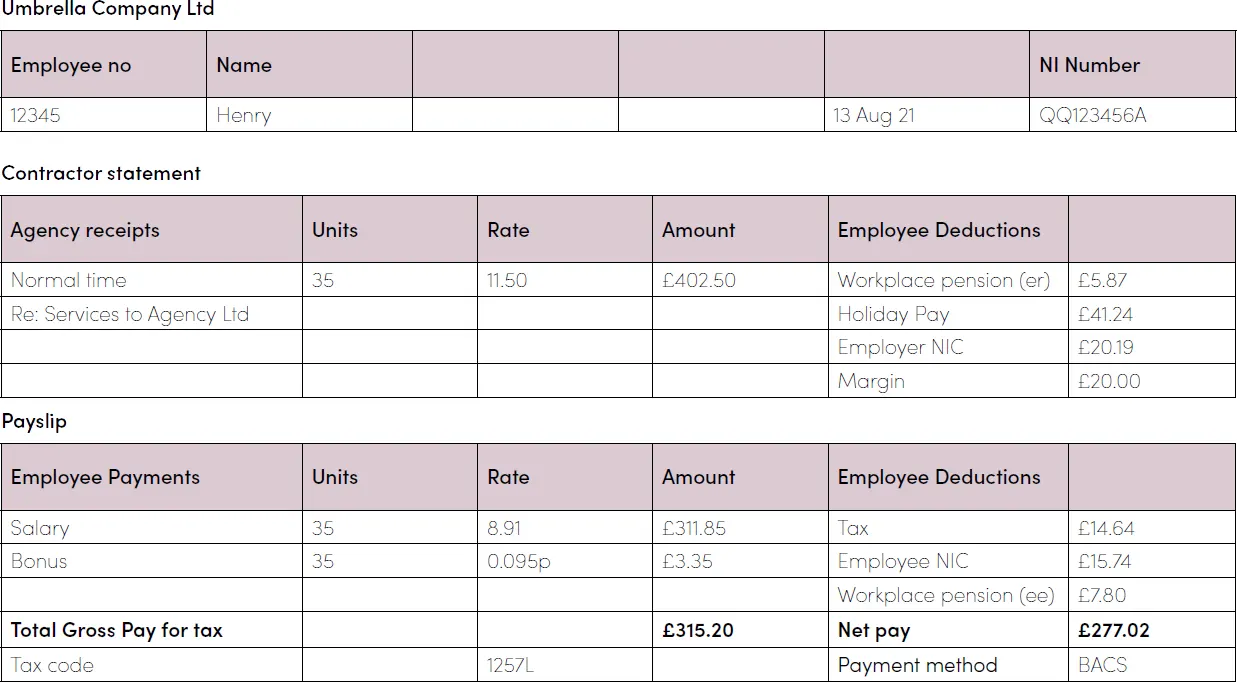

Henry sees a job advertised through an agency, paying GBP9 an hour. He gets the job but the agency then tells him that he should find an umbrella company to work for. Using the table above, Henry knows that he needs to be offered a rate of about £11.51 to work through an umbrella company.

When he gets his first payslip over the page, he sees that the £11.50 rate offered to him has resulted in him getting paid roughly the same amount as if he was paid £9 an hour from the agency (£402.50 less Company Deductions = £315.20 and 35 hours multiplied by £9 an hour = £315).

Saying that, Henry is a bit confused as to why his pay contains a salary element and a bonus element. The umbrella company explains that it is to protect them should they not be paid by the agency. In such cases they have to pay you out of their own pocket – but by structuring your pay like this, this only needs to be for the salary amount.

TIP: Even though many umbrella companies will pay you a salary element (based on the minimum wage) and a bonus element, the bonus element should always be taxable. This is different to where an ‘umbrella company’ offers to pay you a minimum wage element and a non-taxable element (this is likely to be disguised remuneration).

-

Where can I get more help?

There is some information on GOV.UK on working through an umbrella company.

Everything on the LITRG website is aimed at improving the experiences of the low paid. LITRG’s website is full of general, helpful tax information, including more on agency workers, umbrella companies, travel expenses, auto-enrolment and more!